Recent notes:

Rewards

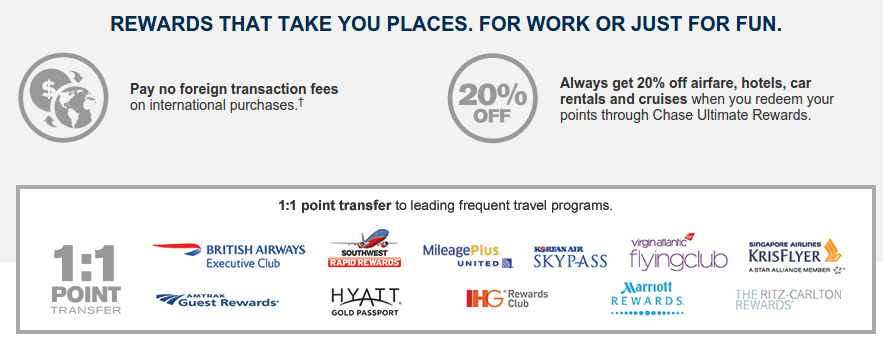

- Chase Sapphire Preferred (1.5)

- Earn 2 points per $1 spent on travel when you use your card to pay for airfare, hotels, cruises, rental cars, train tickets, taxis, tolls and more.

- Earn 2 points per $1 spent at restaurants - from fast food to fine dining.

- 1 point per $1 on all other purchases.

- No fees on foreign transactions

- Chase InkPlus Card (1.5)

- 5 points per $1 on the first $50,000 at office supply stores and on cellular phone, landline, internet and cable TV services.

- 2 points per $1 on the first $50,000 gas stations and hotel accommodations when purchased directly with the hotel.

- 1 point per $1 on all other purchases no limit.

- No fees on foreign transactions

- Chase Hyatt Card (1.4)

- 3 points per $1 spent at all Hyatt properties

- 2 points per $1 spent at restaurants, on airline tickets purchased directly from the airline and at car rental agencies

- 1 point per $1 spent elsewhere

- No fees on foreign transactions

- Chase United MileasgePlus Explorer Card

- 2 miles per $1 spent on tickets purchased from United.

- 1 mile per $1 spent on all other purchases.

- 10,000 Bonus Miles when you spend $25,000 in net purchases on your Card each year

- Free first checked bag, Priority boarding, 2 United ClubSM passes per year

- No fees on foreign transactions

- Amex Cash preferred Card

- 6% Cash Back at U.S supermarkets, up to $6,000 per year in purchases (then 1%)

- 3% Cash Back at U.S. gas stations; 3% Cash Back at select U.S. department stores; and

- 1% Cash Back on other purchases.

- Amex spg. Card (2.0)

- 2 Starpoints for which you may be eligible as a Card Member for each dollar of eligible purchases at participating SPG hotels.

- 1 point on other purchases.

- 2.7% of each transaction after conversion to US dollars

- Receive 5,000 bonus Starpoints when you transfer 20,000 Starpoints to any of nearly 30 participating airline programs – usually on a 1:1 basis.

- Marriott car(0.6)

- 5 points for every $1 spent at over 3,800 Marriott® locations, including our exclusive luxury hotel partner, The Ritz-Carlton

- 2 points for every $1 spent on airline tickets purchased directly with the airline, and at car rental agencies & restaurants

- 1 point for every $1 spent on purchases anywhere else

EARN 10 MARRIOTT REWARDS POINTS OR UP TO 2 AIR MILES PER US DOLLAR SPENT ON ALL QUALIFYING CHARGES AT: JW Marriott Hotels and Resorts, Autograph Collection, Renaissance Hotels, Marriott Hotels and Resorts, Marriott Vacation Club

EARN 10 MARRIOTT REWARDS POINTS OR UP TO 2 AIR MILES PER US DOLLAR SPENT ON YOUR ROOM RATE AT: EDITION Hotels, AC Hotels by Marriott, Courtyard by Marriott, SpringHill Suites by Marriott, Fairfield Inn and Suites by Marriott, Gaylord Hotels, Moxy Hotels, The Ritz-Carlton

EARN 5 MARRIOTT REWARDS POINTS OR 1 AIR MILE PER US DOLLAR SPENT ON YOUR ROOM RATE AT: Residence Inn by Marriott,TownePlace Suites by MarriottGet 70,000 bonus points after you spend $2,000 on purchases in the first 3 months from account opening. This 70,000 bonus point offer is available to you as long as you have not received a new cardmember bonus for this product in the past 24 months.

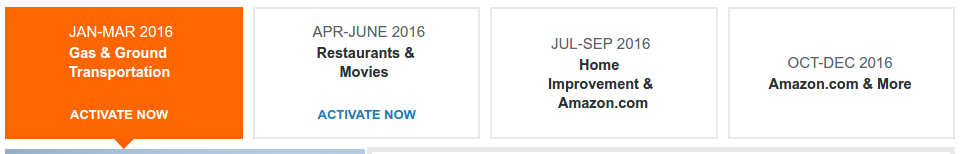

2016 categoreis

Chase Freedom

Citi

Discover Card

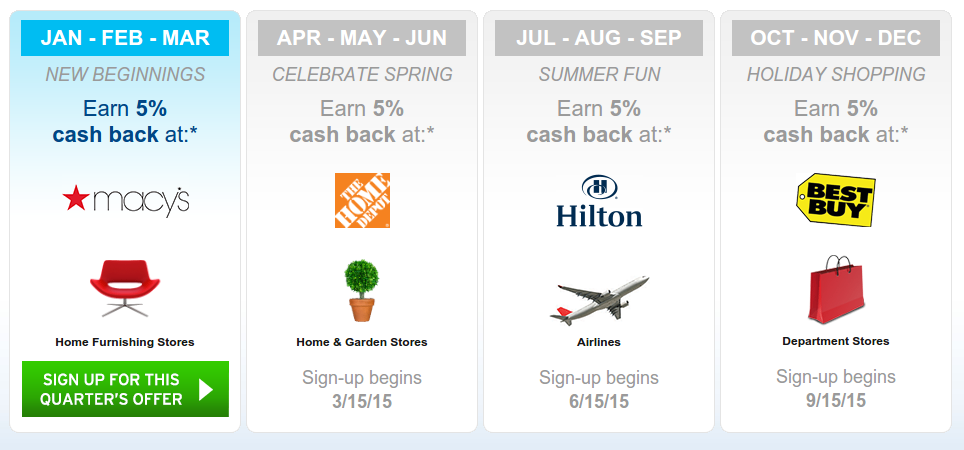

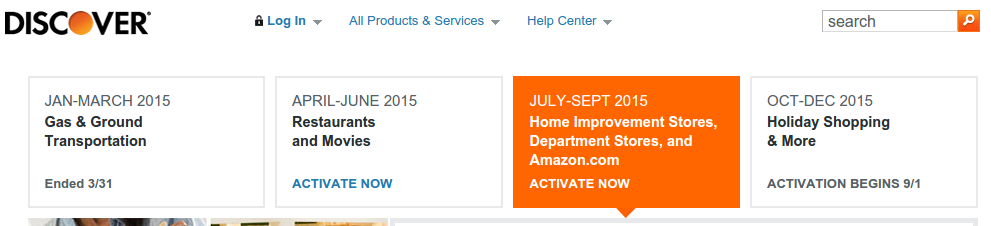

2015 categoreis

Chase Freedom

Citi

Discover Card

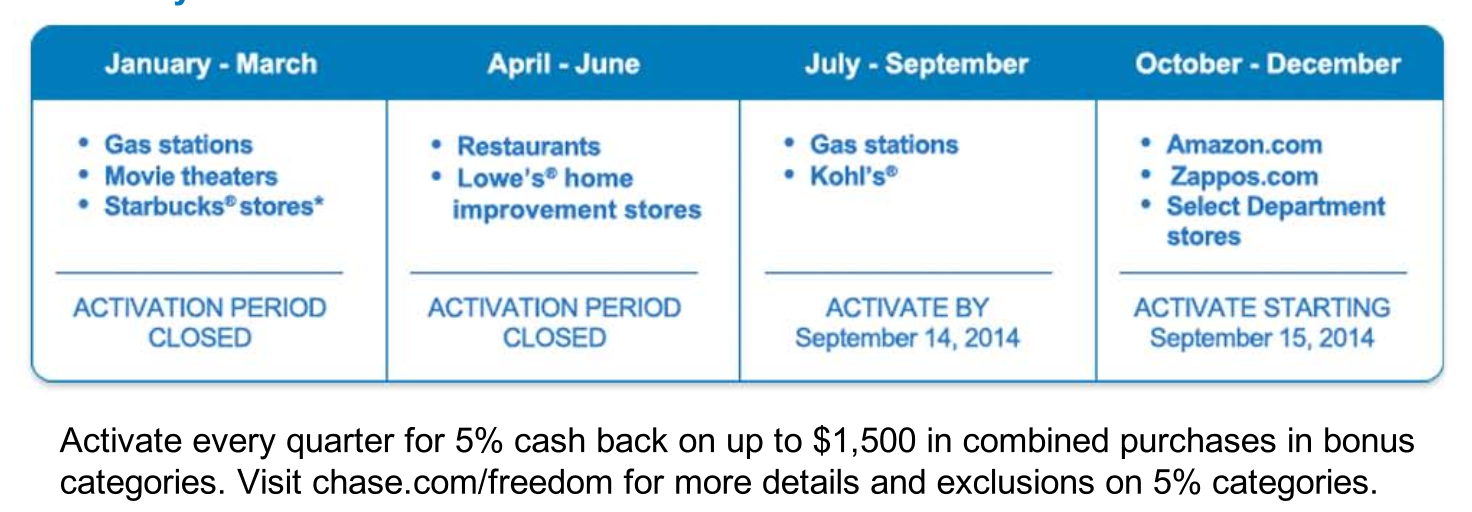

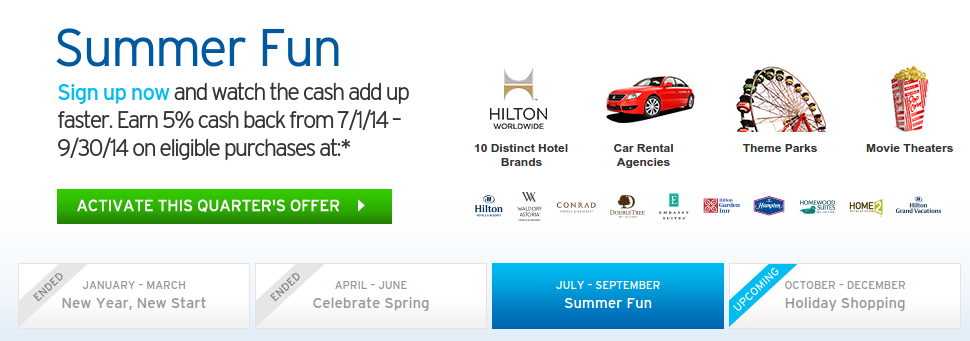

2014 categoreis

Chase Freedom

Citi

Discover Card

InkPlus

Reward points values

- SPG @1.90/1.95

- Lifemiles/Avianca @1.55

- Chase @1.5

- AMEX @1.50

- UA @1.45

- AA @1.4 ~ 1.5

- Air Canada @1.4

- Hyatt points @1.4

- Air France @ 1.35

- Citi Thank you points @1.25 (Premier Card)

- BA @1.05

- Virgin Atlantic @1.0

- Marriott Points @0.6

- Hilton points @0.35

- Club Carlson 0.35

- AA GC/evoucher @0.80/0.75

- AA paper voucher @0.60